Over the last few months, there has been a lot of speculation surrounding the housing market, including whether rising interest rates will negatively impact property prices.

History does not necessarily show this to be true. In this post, we look back over the past 30 years to see how home prices have correlated to interest rate changes.

Most lenders are increasing their home loan interest rates. When interest rates rise, larger mortgage repayments make it more costly to hold a property.

Recent speculation includes concerns that:

- There will be fewer people who can afford to buy a house,

- There will be more properties on the market as investors and homeowners who have overextended themselves try to sell up, and

- Higher rates could cause house prices to fall for an extended period.

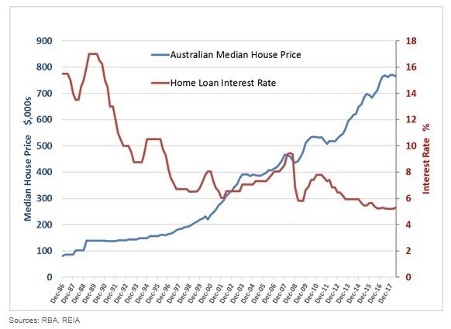

History shows a different picture. Let’s look at the correlation between median property prices and home loan interest rates over the past 30 years.

The 1980s were subject to incredibly high-interest rates. Some property owners were even paying up to 17% interest. As seen in the chart above, the median house price was circa $150,000. However, the average income (per person) was $26,436.801.

Following the chart above, property prices have generally continued to rise regardless of whether interest rates are rising or falling. They indicate that interest rates over the past 30 years have not directly resulted in a fall in the median house price for a significant time.

Historically, sometimes when interest rates fall, the median house price may rise – but it doesn’t always happen this way.

There is little historical evidence to suggest that a rise in interest rates will necessitate a fall in house prices.

Property researchers have many contradictory opinions about a flattening or drop in property prices, but a good property will typically come out on top, no matter the market.

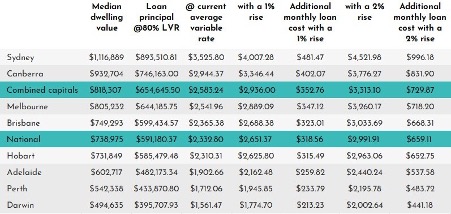

The following table shows your monthly mortgage repayments with a 1% and 2% increase.

Source: theguardian.com/business/2022/apr/29/interest-rates-are-set-to-start-rising-what-does-that-mean-for-mortgage-holders-and-homebuyers – Date: April 2022

Prepare for rate rises

For those with a larger mortgage, we recommend planning for future rate rises now so that it can be managed later on.

For those who have fixed their loans last year or earlier, we recommend starting to plan, so you are not faced with repayment shock when you come off your fixed loan.

There are always opportunities in times of change – we just have to act on them…

We should continue to be wary of treating the Australian property market as if it is just one market where all areas/suburbs perform the same.

The Australian housing market has over 15,000 individual suburbs, each with unique market and individual dynamics.

Whether interest rates go up, down or sideways, there will always be suburbs where prices are also going up, down or sideways, independent of what is happening with interest rates. There are many elements contributing to why property prices move in any direction.

What is important is not where interest rates are heading but what is going on in the suburbs where we own property or plan to invest and how we can ensure those individual suburb trends work in our favour rather than against us.

Don’t stress about interest rates. We have you covered. Our expert team and years of experience will help you stay on top of your financial goals.

Whether investing, purchasing your first home or looking to refinance, our team can tailor competitive loan solutions for you. Book your complimentary Home Loan Assessment with our team today!

Disclaimer:

Terms are subject to approved persons only. This information is true and correct as of 20/08/2022. All of the content above is general in nature and may not suit your personal needs, situation objective & goals.

Sources:

1.ausstats.abs.gov.au/ausstats/free.nsf/0/27DCE5C6FF74CEFBCA2574FF0018707D/$File/63020_AUG1989.pdf

- Australian Bureau of Statistics

- theguardian.com/business/2022/apr/29/interest-rates-are-set-to-start-rising-what-does-that-mean-for-mortgage-holders-and-homebuyers

- abs.gov.au/statistics/standards/australian-statistical-geography-standard-asgs-edition-3/jul2021-jun2026